Alpha Hunter Portfolio Update (Apr 28 2023)

How I aim to consistently outperform the markets with lower risk

Summary

+1.78% annualized outperformance over S&P500 ETF with 34% lower downside risk than the S&P500 ETF using a scalable, (mostly) long-only, no-leverage, usually fully-invested, global large and mid-cap equity strategy. Annualized Information Ratio of +1.76.

Please see the introductory post on Alpha Hunter to understand it better.

Alpha Hunter Portfolio (Apr 28 2023)

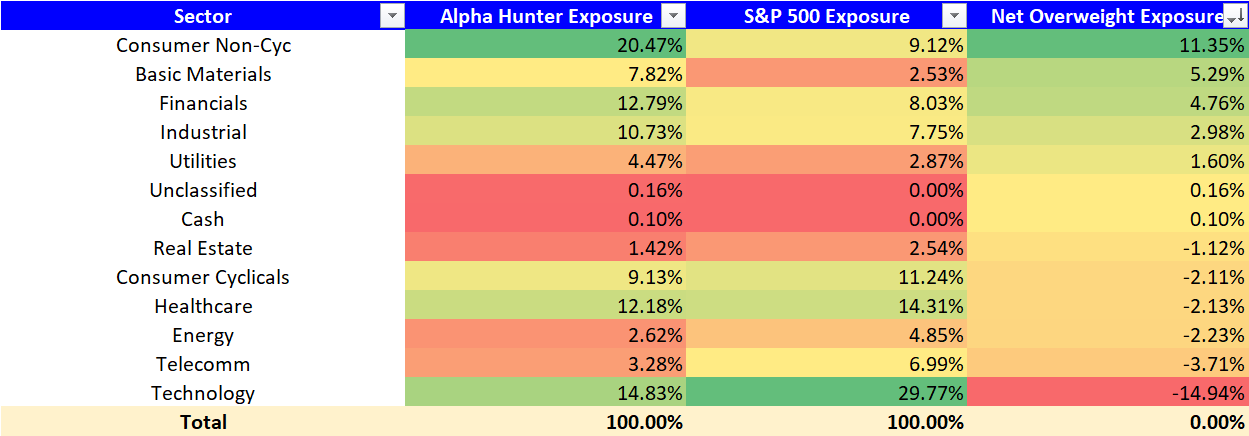

Here are the portfolio characteristics as of Apr 28 2023:

Alpha Hunter Strategy Results

Here is a chart of the alpha generated vs S&P500 over time, net of all fees:

Since Jan 12 2022 till Apr 28 2023, Alpha Hunter has returned a time-weighted return of -7.35%, whilst the S&P500 has returned a time-weighted return of -9.66%, implying an alpha of +2.31%. This corresponds to an annualized alpha of +1.78%.

Here is a summary of key performance and risk statistics, net of all fees:

SPX500 Total Return Index, Berkshire Hathaway Class B stock, and Vanguard’s Total Stock Market Index are used as benchmark comparisons

Alpha Hunter has a +2.5% lower value-added monthly index (VAMI) vs S&P500 Total Return Index

Alpha Hunter’s performance comes with significantly lower risk:

Much lower standard and downside deviations; 34% lower downside volatility vs S&P500 Total Return Index

Much lower max drawdown; 21% lower max drawdown vs S&P500 Total Return Index

Low 0.41 beta

Alpha Hunter’s Annualized Information Ratio (IR) vs the S&P500 Total Return Index is +1.76. It does not matter which way you cut it; this places the performance of Alpha Hunter well within the top percentile of funds:

Source: Informa Investment Solutions

Fundamental Analysis of Positions, Ideas

I regularly publish fundamental analyses here on Seeking Alpha. I invite you to read this to get a better business understanding of various positions (past or current).

Disclosure

Solutions must fit the circumstances and conditions present in the goal or problem. It is impossible to prescribe a specific solution without knowing these circumstances and conditions! This is a general principle.

I do not know our readers’ circumstances or conditions present in their financial status and goals. Hence, I cannot prescribe or recommend any specific solution. Therefore, please view what I write about simply as my humble opinion, which you are free to consider or not consider in whatever way you wish.

You can’t claim to be a superior to the index investors and hold a majority of your $ in the index.

I do not mean to be too critical ,but your are engaged in double speak. Your holdings are purported to be superior to that of an index that is included as > 50% of your holdings. If your holdings are uniquely superior to the index, then you would not hold the index fund at all, because it can only be a negative drag on your holdings' performance.